The fundamental of funding a business is to keep it simple, useful and productive. If you take out a loan it is important that you borrow only that much which is affordable to you. This is because any loan is supposed to be repaid in excess of the amount actually borrowed as there will be a predetermined fixed rate of interest added to the actual amount borrowed.

Unless you have a seemingly endless source of money to flow in steadily, you will surely need access to capital. In fact, all businesses these days whether it is a startup or a large-cap company, need capital infusions on a regular basis to meet with their short term obligations effectively. This need is even more for small businesses.

All these facts point towards one thing which is you will need to find the right type of funding model for your business irrespective of its size and nature of operation and dealings. If you are scammed or tempted by a wrong source and borrow money, you will not only lose the money but may also lose a part of your company as the case may be.

No matter what the end result is, you will surely find yourself confined within the repayment terms of the loan. This will seriously hurt your reputation and at the same time impair the growth of your business for many years into the future provided you do not shut it down prematurely in frustration.

Debt financing

Debt financing is the first type of funding option that you may consider for your business. However, it is good to understand this model better so that you make the right choice and manage your business funds accordingly as well.

The best examples of debt financing are mortgage and automobile loan. Well, if you think what it has got to do with your business, then be informed that it works in the same way. Debt financing typically comes from a bank or any other lending institution such as Liberty Lending or any similar ones. However, it is possible for the private investors to offer debt financing to you but usually that is not the norm.

Debt financing works in the following way:

- After you decide to take it, you will approach the bank and fill in an application

- The bank will scrutinize your application and check your personal credit if you are a startup or your business is still in the early stages of development

- If your business is of a complicated corporate structure have been in operation and existence for a long period of time, the banks will also check other sources to look at the credit history of your business and

- Apart from the credit history of your business, the bank will also examine the books of accounts and then complete other due diligence.

It is therefore advised that before applying you make sure that all records of your business are complete, true and organized. Once the bank approves your loan application they will set up the rate of interest, the amount to offer and the payment terms.

Though the process of debt financing is very simple and seems much similar to other loaning processes followed by the bank, you must weigh the pros and cons before you apply for such a loan.

There are different advantages of financing your business through debt such as:

- The lender will have no control over your company’s operation or have any ownership

- The relationship with your lender ends as soon as you repay the loan amount along with the predetermined interest

- It helps your business to retain its value and status

- You can accurately include the monthly payments as well as its breakdown in your forecasting models and

- The interest that you pay on debt financing is a business expense and considered to be tax deductible.

However, there are a few downsides that debt financing may come with when you opt for it to fund your business. These disadvantages are:

- There is no certainty especially for the small businesses or those that are in its early stages that including a debt payment to their monthly expenses will always ensure the desired capital inflow to meet all the expenses of the business and

- Small business lending may be a bit tough to receive especially during the tough times in the economy until and unless your business is excessively qualified.

The US Small Business Administration urges certain banks to offer small business loans. This is because a part of this loan is guaranteed by the full faith and credit of the government of the United States.

Moreover, these loans are designed to reduce the risk of the lenders when they make loans to the business owners especially those who may not have qualified otherwise to receive any such loan. To know more about debt financing as well as other SBA loans and its pros and cons you can visit the SBA’s website.

The alternative options

No matter how impressive debt financing may seem to you to fund your business, it is always best to know about the alternative options as well if you need funds to run your business.

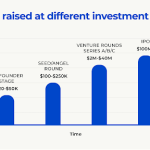

Equity financing is such an alternative option that is offered by investors who are more commonly called angel investors and venture capitalists.

- The venture capitalist is a firm, rather than an individual and has partners, accountants, teams of lawyers, and investment advisors. Their job is to perform due diligence on any potential investment which is often large to the tune of $3 million or more. Naturally, the funding process is slow and complex.

- Angel investors, on the other hand, are usually wealthy individuals looking for companies in which they can invest a small amount of money for a single product instead of the entire business building project. Typically Angel investments are fast and contain much simpler terms.

You may also try out mezzanine capital which is a combination of equity and debt financing and even asks your friends and family. However, each will have its pros and cons that you should consider.

Author Bio

Marina Thomas is a marketing and communication expert. She also serves as a content developer with many years of experience. She helps clients in long-term wealth plans. She has previously covered an extensive range of topics in her posts, including money saving, Budgeting, business debt consolidation, business, and start-ups.